Debenture

Short definition

A debenture is a marketable security that businesses can issue to obtain long-term financing without needing to put up collateral or dilute their equity.

A debenture is a type of long-term business debt not secured by any collateral. It is a funding option for companies with solid finances that want to avoid issuing shares and diluting their equity. Debentures can also be useful for companies that don’t want to tie up assets or who lack collateral for a traditional loan.

How does a debenture work?

A debenture is a legal certificate that states:

- how much money the investor gave, which represents the principal

- the interest rate to be paid

- the schedule of payments

Investors usually receive their principal back when the debenture matures, at the end of its term. That means the business typically only pays the interest during the loan period. The interest represents a percentage of the face value of the certificate or loan amount. The business then repays the full principal (the loan amount) when the certificate matures.

“Debentures can be a financing option for entrepreneurs who don't want to give up share value or for fast-growing firms that don’t have a lot of assets,” says Alka Sood, a consultant with BDC’s Advisory Services who counsels businesses on financial management and strategic planning.

Debentures are a form of debt capital. They are recorded as debt on the issuing company’s balance sheet.

“A debenture is a type of unsecured long-term business loan,” Sood says. “Since debentures are unsecured, businesses issuing them generally need to be creditworthy, have a good reputation and show a history of positive cash flow.”

Unlike a typical loan, a debenture owner, the person or entity lending the money, can sell the debenture to another party. This is what makes it a marketable security. Some corporate debentures are traded on stock exchanges.

A debenture owner typically faces less risk than a shareholder because interest payments on a debenture are generally made before share dividends are paid.

Convertible debentures

Some debentures are convertible. The owner of a convertible debenture has the right to convert the loan into shares of the issuing business under the conditions set out in the debenture certificate. A debenture can also be partially convertible, which means part of its value can be converted into shares and cash.

Features of a debenture

A debenture certificate typically covers the following details:

- amount of the loan

- interest rate, called the coupon rate

- repayment schedule to pay the interest and principal, sometimes called the redemption schedule

- maturity date

- convertibility of the debenture

- credit rating of the debenture

- seniority of repayment, that is when the debenture will be repaid in relation to other liabilities in the event of bankruptcy or liquidation

How are debentures structured?

Debentures are long-term loans and generally have a maturity date of five to ten years. Since they’re unsecured, the issuer typically offers a higher interest rate than they would pay for a secured loan or bond. This is to offset their increased risk.

In the event of bankruptcy or liquidation, debentures are paid after secured debt, but take priority over common and preferred shares. Depending on the terms, debentures can be placed in a more senior position than other unsecured loans.

How to account for debenture on a balance sheet

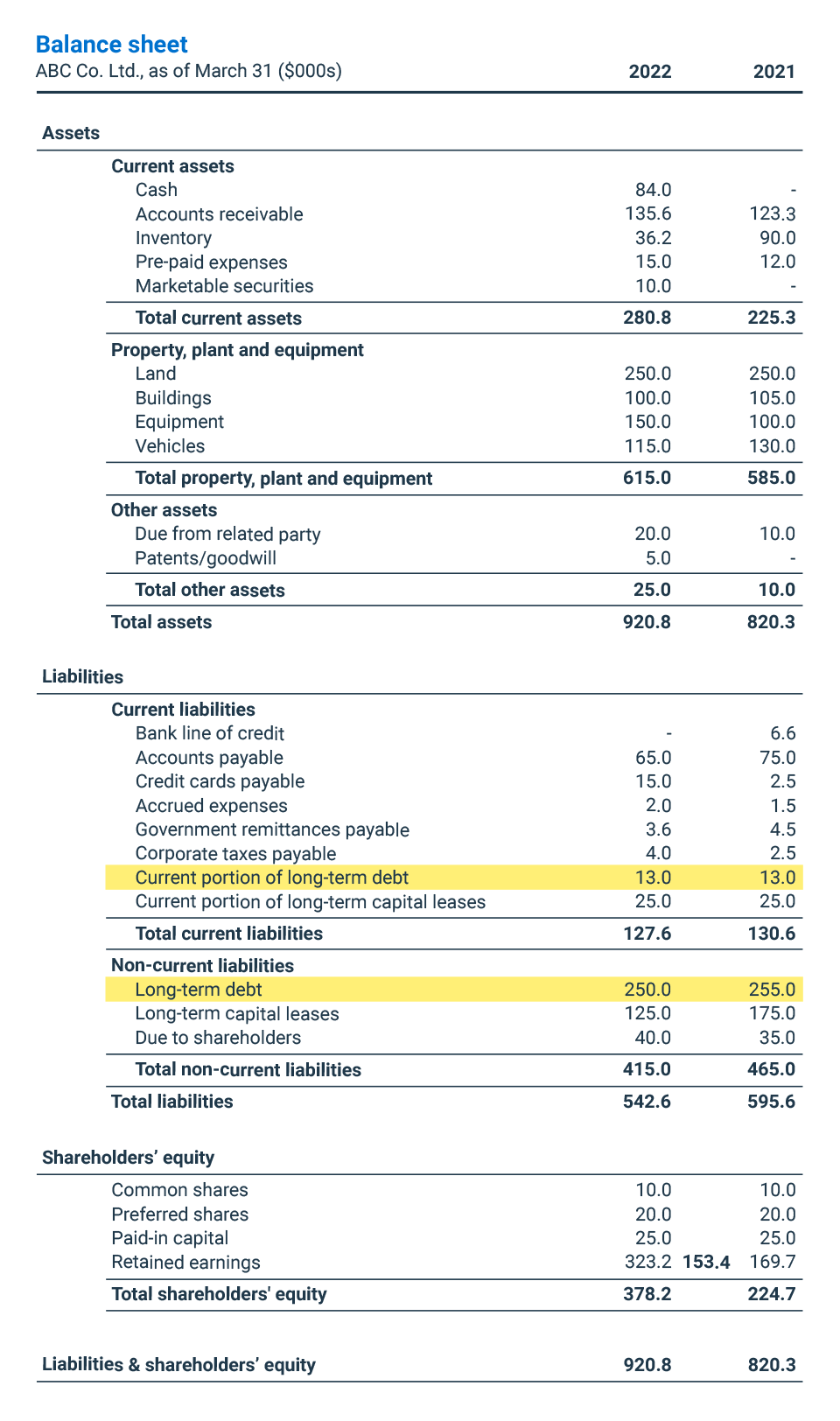

Debentures don’t typically appear as a separate item on a company’s balance sheet or other financial statements. Debentures are included as part of long-term debt in the liabilities section of the balance sheet, within the subsection for non-current liabilities, that is debt with a maturity date greater than one year.

For example, a business may issue a debenture with the following terms:

- par value of $1,000,000

- annual interest of 6%

- maturity date of January 31, 2030

In this example, debentures would be included in the $1,000,000 long-term debt. The annual interest payment would be $60,000 per year (or $5,000 per month). The business borrowing the money would repay the full $1,000,000 on January 31, 2030. In the company’s fiscal year that includes January 31, 2030, the loan amount of $1,000,000 would appear on the balance sheet under the current portion of long-term debt.

On the sample balance sheet below, the lines for long-term debt and the current portion of long-term debt are highlighted in yellow.

Depending on the type of financial statement and its level of detail, the notes to the financial statements may outline what debentures the company has issued. A review engagement or audited statement would likely disclose such information, while a notice to reader may or may not. A debenture is typically categorized as an unsecured long-term loan, with the term “debenture” not typically appearing in the notes.

How are debentures redeemed?

Debentures are redeemed and repaid according to the terms set out in the debenture certificate. This can take a variety of forms, including:

- lump-sum payment of interest and principal on maturity

- annual, semi-annual or other instalment schedules

- full or partial conversion into equity shares or a new debenture

Debenture vs. bonds: What is the difference?

Debentures and bonds are similar. Both offer businesses ways to raise money through debt. Here are some key differences:

| Debenture | Bond | |

| Secured | No | Can be secured or not secured |

| Maturity date | Typically long-term | Can be long- or short-term |

| Convertibility | In some cases | No |

| Seniority | After bonds | Before debentures |

Difference between a debenture and shares

A debenture is a long-term debt and appears in the liabilities section of a company’s balance sheet. Meanwhile, shares are the company’s obligation to shareholders; their value is recorded in the shareholders’ equity section of the balance sheet.

Difference between a debenture and a loan

While a debenture is a type of business loan, not all business loans are debentures. For example, a secured loan, i.e. one backed by collateral, isn’t a debenture. A debenture is issued by the business receiving the loan as a promise to repay a borrowed sum. Traditional loans are issued by the lender.

It’s important to note that not all unsecured loans are debentures. For example, some financial institutions offer businesses working capital loans that are not secured by any collateral. Working capital loans aren’t debentures; they are issued by the lender. A debenture, on the other hand, is issued by the business receiving the borrowed amount.

Who can issue a debenture and how?

To issue a debenture, a company issues a document called a debenture certificate, which is a promise to repay the borrowed sum. The certificate spells out terms such as the amount borrowed, the interest rate and other conditions of the loan.

Because a debenture isn’t backed by collateral, the issuing business generally must be creditworthy, have a good reputation and show a history of positive cash flow.

Next step

Discover how to analyze your financial information to increase revenues, reduce costs and set a competitive price for your goods or services in our free guide for entrepreneurs: Build a More Profitable Business.