Preferred shares

Preferred shares are issued to business owners and other investors as proof of the money they have paid into a company. They make up one part of a company’s shareholder equity, the other two being common shares and retained earnings.

Like common stock, preferred share investments are unsecured, but they are issued with specific terms of payment. Payments occur in the form of dividends. The payments are not a legal requirement until they are declared by the company.

Preferred shareholders stand ahead of common shareholders in the payment of dividends and they have a priority claim to assets if the company is liquidated. They are paid as soon as all obligations to creditors have been met. Common shareholders come after. It is this “preferential” treatment that explains the name of the holders of these shares.

More about preferred shares

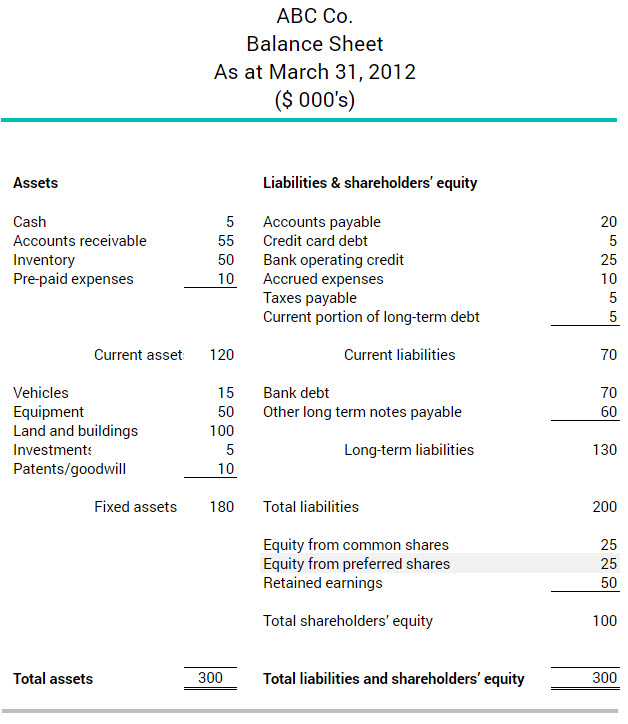

Both preferred and common shares appear under shareholders’ equity on the balance sheet, as shown in the example below: