Balance sheet

The balance sheet is one of the fundamental documents that make up a company’s financial statements. It provides a summary of your company’s financial position at a point in time and provides a clear picture of what you own and what you owe. A review of several balance sheets allows you to track your company’s liquidity over time.

Banks and investors will also look at the balance sheet to better understand the financial health of your company before investing in it or lending you money.

“The balance sheet not only provides you with a snapshot of what the company is like at that moment, but it’s an important document used by lenders to assess a loan request,” says Fanny Cao, Senior Advisor, Product Development at BDC.

Cao says that a balance sheet allows you to see whether the company has sufficient funds to invest in its operations. It classifies your assets and liabilities by short- and long-term. You see the obligations that you have to meet within the next year .”

In this video, BDC Manager Nicolas Leblanc explains what a balance sheet is and why it’s a key document for business owners.

The 5 main parts of a balance sheet

1. Current assets

Cash, as well as other assets you expect to turn into cash within the next 12 months. Examples of current assets include accounts receivable, inventory and investments that can be quickly converted into liquidity.

2. Fixed assets (long-term assets)

Property or equipment the company owns and uses in its operations to generate income. Fixed assets are purchased for long-term use (longer than one year). The value of property and equipment may decrease over time because of amortization, which is intended to spread out the cost of fixed assets over their period of use or wear.

3. Current liabilities (short-term liabilities)

Debts and other obligations to creditors that will be due within the next 12 months. Examples of current liabilities include accounts payable, credit card bills, sales taxes collected, payroll liabilities and loan payments.

4. Long-term liabilities

Debts and other obligations to creditors that will not be due in the next 12 months, excluding demand loans. Examples of long-term liabilities include term and mortgage loans.

5. Shareholders’ equity

Shareholders’ equity is made up of common and preferred stock, paid-in capital as well as retained earnings. Note that some preferred shares may sometimes be part of liabilities under certain conditions.

As a lender, we use your balance sheet to see how comfortable we would be in lending money to your company.

Fanny Cao

Senior Advisor, Product Development, BDC

What is a balance sheet also known as?

A balance sheet is also sometimes referred to as a statement of financial position, a statement of financial condition or a statement of assets and liabilities.

What is the purpose of a balance sheet?

The balance sheet reveals the book value of a company’s assets, liabilities and shareholders’ equity.

Cao says a balance sheet’s figures will lay out both the short- and long-term assets and liabilities. “You want to make sure that current assets are higher than current liabilities. It will help you to know that if you have to pay down all your current liabilities tomorrow, you would have enough cash available from your current assets.”

A balance sheet is used to measure some of the company’s key ratios, such as:

These ratios are calculated at set periods, such as in yearly, quarterly or monthly reports.

“It offers a way to see how efficient and how liquid the company is,” says Cao. As a lender, we use your balance sheet to see how comfortable we would be in lending money to your company.”

The balance sheet is also deeply connected to the other financial statements and can’t really be analyzed independently of the other statements

Let’s say you decide to buy a truck. That truck will show up as an asset on the top of your balance sheet, while the loan you took out to purchase the truck will be shown as a liability at the bottom.

At the end of the financial year, your accountant will record in the income statement an amortization expense that represents the reduction in the value of the truck resulting from wear and tear. That amortization is calculated based on the useful life of the asset.

The cash flow statement takes your net income and adds back the amortization because it is not a cash expense. These changes in turn affect the ending cash balance, which will be shown on the balance sheet. The truck will be shown on the balance sheet at a reduced value because of amortization.

The notes to the financial statements explain any assumptions made during the preparation of the balance sheet. Accountants will indicate the basis for accounting used to prepare the document.

How to read a balance sheet

As shown in the formula calculation below, in your balance sheet, your total assets should always equal your total liabilities plus shareholder’s equity.

This simple formula tells you that everything a company owns is either paid by borrowing money (liabilities) or by taking it from investors.

Example of a balance sheet

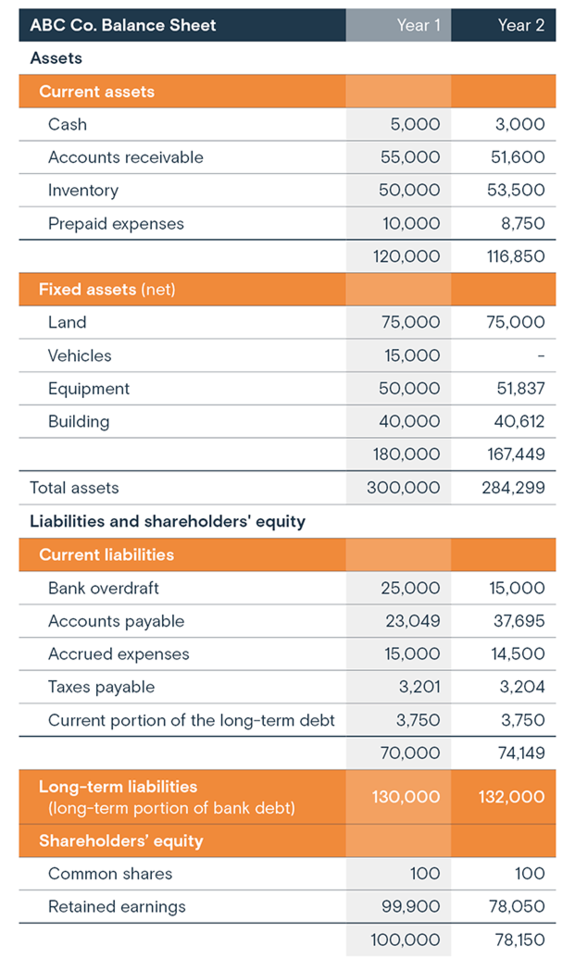

In the balance sheet below, the current assets and fixed assets are shown at the top of the balance sheet. Assets that can most easily be converted into cash are listed first.

That same logic often applies to the liabilities and shareholders’ equity sections, where the most liquid elements generally appear first.

Showing two years on a balance sheet allows you to track changes from one reporting period to the next.

This example also shows that the total assets are equal to the sum of liabilities and equity.

Total assets = total liabilities + shareholders’ equity

Year 1: 300,000 = 200,000 + 100,000

Year 2: 284,299 = 206,149 + 78,150

Free balance sheet template for entrepreneurs

We generally advise clients to generate their financial statements through accounting software or with the help of their accountant.

However, if you need to create a balance sheet manually, you can download our free, fillable balance sheet.

How does a banker look at a balance sheet?

When a banker analyzes your company’s balance sheet, he or she calculates specific ratios to determine whether your business will be able to repay the loan. Here are three examples.

Current ratio

One of the ratios they will calculate is the current ratio (also called the working capital ratio), which measures your company’s ability to pay its current liabilities with its current assets. Investors will also calculate this ratio before investing in your business.

The current ratio is determined by dividing total current assets by total current liabilities.

Here is the calculation of the current ratio for ABC Co. using the balance sheet example above for the end of Year 1.

This makes for a current ratio of 1.71, meaning that the company has $1.71 available to pay every dollar of debt.

As a general rule, higher current ratios indicate a lower risk that the business will run out of cash. If your current ratio is well above 1, your company is more likely to meet its financial obligations. If your current ratio drops and is close to 1, paying all your bills on time will become more difficult.

Debt-to-equity ratio

The debt-to-equity ratio compares the percentage of financing that comes from creditors and investors to the amount of equity held by shareholders.

The debt-to-equity ratio is calculated by dividing a company’s total liabilities by the total equity of its shareholders.

Here is the calculation of the debt-to-equity ratio for ABC Co. using the balance sheet provided above for the end of Year 1.

It shows that the company carried $130,000 in long-term debt and $70,000 in short-term debt in Year 1, while investors held $100,000 of equity in the business. This makes for a debt-to-equity ratio of 2.

Many companies have a ratio that is considerably higher than 1, meaning they have more debt than equity. Generally speaking, the debt-to-equity ratio is higher in industries that require a high proportion of technical investment in relation to salaries. An example of this would be a trucking company.

Debt-to-total assets ratio

The debt-to-total assets ratio shows how much of a business is owned by creditors versus how much of the company’s assets are owned by shareholders.

The debt-to-total assets ratio is calculated by dividing a company’s total liabilities by the total equity of its shareholders.

Here is the calculation of the debt-to-total assets ratio for ABC Co. using the balance sheet shown above for the end of Year 1.

It shows that at the end of Year 1, the company carried $130,000 in long-term debt and $70,000 in short-term debt, with assets totalling $300,000. This makes for a debt-to-equity ratio of 0.67.

The lower the business’s debt-to-total assets ratio, the greater the leverage. Conversely, the higher your debt-to-total assets ratio, the greater the likelihood that you may be unable to meet your financial obligations.

Balance sheet vs. income statement

The balance sheet shows a company’s total assets and liabilities at a specific point in time. The income statement shows a company’s revenues, expenses and profitability over a specific period, usually a month, a quarter or a year.

Does the balance sheet show net income?

A balance sheet does not show net income directly. However, net income is used to calculate retained earnings, which are the amount of profit a company has left over after paying all costs, taxes and dividends.

Do accounts receivable go on a balance sheet?

Yes, accounts receivable are typically included on a company’s balance sheet as a current asset.

Next step

Download our free guide for entrepreneurs, Understand Your Financial Statements, to receive more financial management tips and advice.