Loans to help you overcome trade challenges

Advice to guide you through uncertainty

Free resources to boost your business resiliency

Links to partners for extra support

Supporting Canadian businesses for over 80 years

We know that business as usual has changed. It’s time to take action so your business can come out stronger. Together, let’s keep moving forward.

Always there for you

As the only bank devoted exclusively to Canadian entrepreneurs, we know business can ebb and flow. We take the time to fully understand your business, so our solutions can match your reality.

Support beyond numbers

Our flexible terms, such as principal payment holidays and repayment schedules matched to your cash flow, give you breathing room to get through tough times.

Building your resiliency

When the path forward is unclear, our experts can help steer you with practical, results-oriented advice tailored to your needs and stage of growth.

Pivot to grow loan

Boost your cash flow while your business adapts to a new trading landscape with up to to $2M to help counter the effects of tariffs on Canadian exports to the U.S.

Good track record of profits

Annual sales requirement of $2M or more, with demonstrated profitability and positive cash flow.

Proven chance of being harmed by U.S. tariffs

At least 25% of sales must come from U.S. exports, or there must be a significant risk of negative impact from U.S. tariffs or related uncertainty.

Preferred rates so you can take action

Take advantage of preferred interest rates to help you quickly pivot your business.

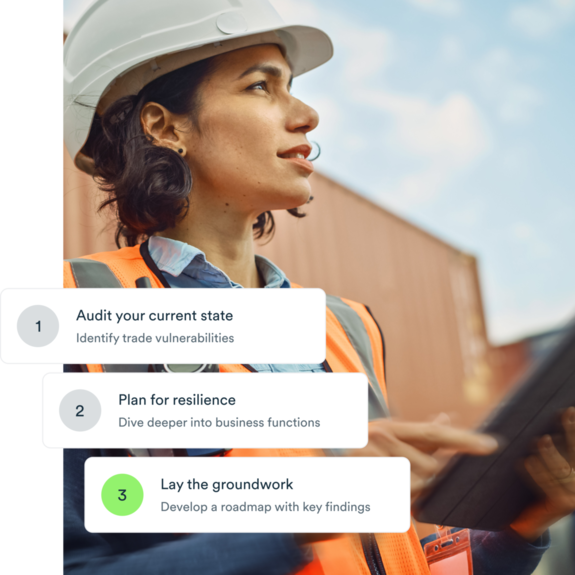

Trade resilience consulting offer

Get expert advice to help you plan for resilience in an uncertain trade environment and build a forward-looking strategy to tackle tariffs head-on.

Audit your current state and identify trade vulnerabilities

Know your vulnerabilities and strengths and understand the full impact of trade volatility.

Build a resiliency plan for your business

Get actionable recommendations for your finances, operations or market diversification plans from subject-matter experts.

Get started right away with special pricing

We cut our costs to make our coaching and support more accessible to Canadian entrepreneurs.

Is your business ready to face external shocks?

Try our self-evaluation to understand how vulnerable your business is to market volatility and where you can improve.

Articles and tools to help your business

How to diversify your business

Download this free guide to start preparing an exit strategy that will lead to a smooth transition.

How to master your cash flow

Discover ways to boost your cash flow with strategies for better forecasting and management.

List of tariff assistance programs

Get a list of federal, provincial and municipal programs in place to assist companies affected by U.S. tariffs.

Frequently asked questions

BDC is a Crown corporation dedicated exclusively to Canadian entrepreneurs. We primarily support small and medium-sized businesses across all industries and growth stages with:

- Loans and other forms of financing with flexible repayment terms tailored to your needs

- Expert, hands-on consulting, along with free resources and tools to help you build a successful, resilient business

- Specialized financing, including venture capital.

As a development bank, our role is to help Canadian businesses build the resiliency to thrive in good times and in bad. We know that in the current economic environment, trade uncertainty with our most important trade partner is a major challenge for our clients and all entrepreneurs.

To help you, we have specialized financing and consulting offers that are tailored to the current situation. We also have a host of free articles and tools with valuable advice to help you manage all facets of your business with confidence.

Our economic research team also provides regular data and analysis to help you understand the current environment and its impact on the Canadian economy.

Because running a business can be stressful even at the best of times, we also have resources to help entrepreneurs balance their mental health. Read groundbreaking research on how mental health challenges affect entrepreneurs specifically, hear stories from other business owners and get strategies to help build balance in your work and personal life.

We help Canadian entrepreneurs thrive, with tailored financing and flexible repayment terms. We offer financing for every need and every stage of growth, such as:

- Cash flow crunches

- Equipment purchases

- Business ownership changes

- Commercial real estate

- And more

BDC finances a broad range of projects across most industries. However, as a Crown corporation, we do not provide financing for:

- Government agencies, charities, religious or fraternal organizations

- Residential property businesses

- Bars, cocktail lounges or pawn shops

- The marijuana industry and cannabis-related activities

- Cryptocurrency mining (blockchain encryption)

- Businesses involved in:

- Overnight accommodations for those requiring care

- Weapons manufacturing, sale or distribution

- Sexually exploitative activities or those against community standards

- Trade in federally prohibited countries

BDC’s Advisory Services is a paid consulting service that offers advice and guidance from seasoned experts to help you solve your business challenges.

Consulting services are delivered by a team of over 500 experts across Canada, each bringing deep industry knowledge and specialized business expertise.

Throughout the mandate, a designated team will work closely with you, offering practical, results-driven advice tailored to your specific situation.

Our Advisory Services are available to businesses of all sizes and at every stage of growth, in areas such as:

- Leadership and management

- Business strategy

- Sales and marketing

- Financial management

- Operational efficiency

- HR management

- E-commerce

- Digital technology

“We know at BDC, that overcoming challenges is part of your DNA. We continue to believe in your ability to find your way to growth despite the odds.”

Isabelle Hudon, President and CEO — BDC

Buy 5 High 5: Buy Canadian, make a difference

The Buy 5 High 5 challenge invites you to swap five foreign products for five Canadian products to improve our economy. Check out the list of companies Canadians are sharing and learn how spending just $25 a month on Canadian products can have a positive impact!