Dividends

Dividends can be an important tool for companies. For owners of smaller businesses, they can provide an alternative to salaries. For larger businesses, they can signal financial health and build shareholder confidence.

Nicholas Hamel, Senior Account Manager, Technology Industry at BDC, explains what dividends are and why your company might want to distribute them.

What is a dividend?

A dividend is a payment to a company’s shareholders out of its earnings after tax. Dividends are a way for shareholders to earn a return based on the amount of risk they have taken.

Company dividends are often paid in accordance with a dividend policy. However, they are approved and declared by the board of directors. Shareholders are paid based on the number of shares they own.

Is it better to pay yourself a salary or to distribute dividends?

To compensate for their efforts, business owners can pay themselves either a salary or dividends. “Each of these solutions has its advantages and disadvantages,” says Hamel. Here is an overview:

| Advantages | Disadvantages | |

|---|---|---|

| Salary | Your salary is considered a deductible business expense. | It’s generally taxed at a higher rate than dividends, especially in higher salary ranges. |

| A salary increases your employment income, meaning you can benefit from government plans such as pension, employment and parental insurance in the future. | You must pay contributions to these government plans. | |

| You accumulate contribution room for your registered retirement savings plan (RRSP). | ||

| Dividends | Dividends can reduce your personal taxes, as they are often taxed at a lower rate. | You do not accumulate any contribution room for your RRSP. |

| You don’t have to contribute to several government plans and can use the money you save in other ways. | Amounts from government plans to which you may be entitled will be reduced since you aren’t contributing to them. |

Deciding whether to pay yourself a salary or dividends depends largely on your personal situation and that of your company. Business owners generally choose a combination of both options. “The short but somewhat boring answer is that it depends,” says Hamel. “Check with your tax specialist to choose the best strategy. It’s essential.”

Check with your tax specialist to choose the best strategy. It’s essential.

Nicholas Hamel

Senior Account Manager, Technology Industry, BDC

Where are dividends reported in financial statements?

If you’re unfamiliar with financial statements, you may not know where to look for dividends. Here’s where you can find them.

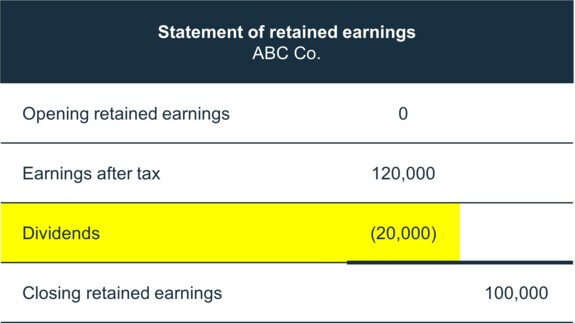

Statement of retained earnings

Dividends distributed to shareholders aren’t recorded as expenses in a company’s income statements.

They’re often most clearly indicated in the statement of retained earnings, although this isn’t mandatory for all companies.

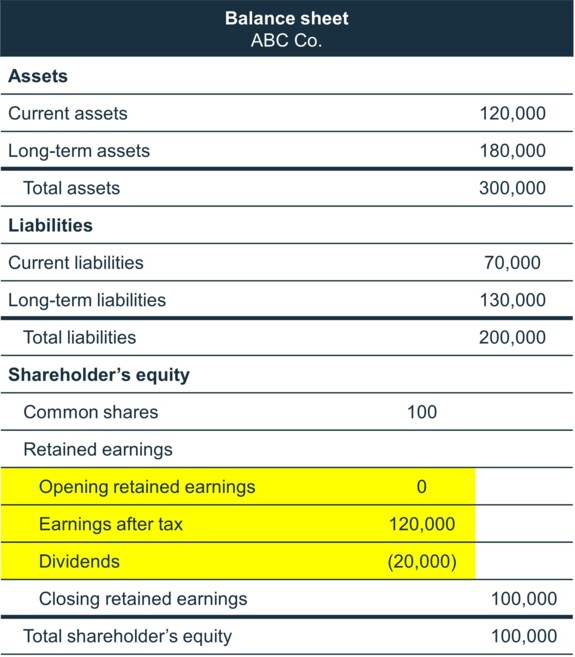

Balance sheet

When a company doesn’t provide a statement of retained earnings, dividends can be found in the balance sheet, where they affect the shareholders’ equity section, or more specifically, the amount of retained earnings recorded on the balance sheet.

This balance sheet presents retained earnings in the shareholders’ equity section.

Dividends aren’t usually recorded verbatim on the balance sheet and must be calculated from the retained earnings.

Closing retained earnings are calculated by taking the retained earnings from the previous period, adding the net income, and then subtracting the dividends.

This is the calculation formula:

Retained earnings = Opening retained earnings + Earnings after tax - Dividends

In this example, if ABC Co.’s earnings after tax are $120,000, the dividends paid in year 1 would be $20,000.

Retained earnings ($100,000) = Opening retained earnings + Earnings after tax ($120,000) – Dividends ($20,000)

The retained earnings can then be used for ongoing operations or investment purposes.

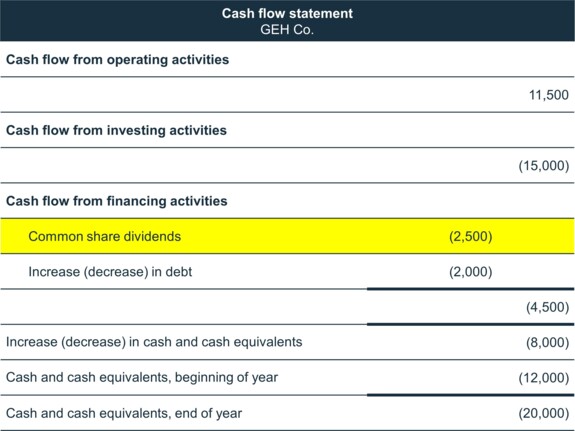

Cash flow statement

Paid dividends are also recorded in the cash flow statement as cash outflows. This means they reduce a company’s cash position. In the cash flow statement, they’re recorded either as financing activities or as operating activities, depending on the accounting standard used by the company.

This cash flow statement presents dividends in the Cash flow from financing activities section. If the company used a different accounting standard, they would put it in the first section, cash flow from operating activities.

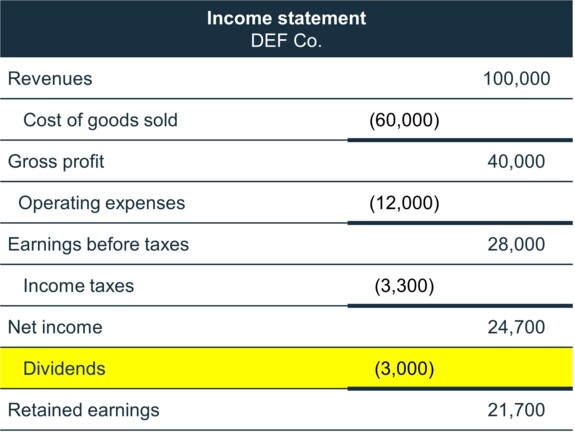

Income statement

Smaller companies may present the calculation of retained earnings, which includes dividends, in their income statement. However, they still do not directly impact net revenue or business earnings.

This income statement shows paid dividends being subtracted from earnings after tax to obtain retained earnings. This amount is added to the retained earnings account on the balance sheet, as shown in the first example.

Can dividend payments hinder a loan application?

“Dividend payments can hinder a loan application in some cases,” says Hamel. He provides the example of a business that’s spending a lot because it’s in a growth phase. In this case, distributing a significant portion of its earnings as dividends may be poorly perceived. The lending institution reviewing the application will wonder why the company isn’t using its earnings to stimulate growth instead.

Questions will also be raised if the payments exceed the comparison standards. “Take the example of a business owner with 15 employees who pays himself $300,000,” says Hamel. “If market comparables show paid salaries or dividends of around $125,000, the loan application will be questioned. Unusually high dividend payments can make it seem like the purpose of the loan application is to finance the salary rather than grow the business.”

On the other hand, in the case of a more mature company with steadier cash flow, dividends can bolster a loan application. Here they may be interpreted as a sign of good governance, especially if the company has a consistent history of dividend payments.

Nevertheless, the decision to distribute dividends or pay a salary will have little impact on a loan application, as both are considered when analyzing a company’s financial situation. Financial indicators such as the debt service coverage ratio that includes dividends, the debt-to-equity ratio or the working capital ratio will be affected by salary or dividend payments.

How do you write a dividend policy?

The distribution of a dividend requires careful consideration. Hamel strongly recommends establishing a dividend policy if you’re considering it.

Such a policy will explain your intentions for dividends to both shareholders and lenders. It will help them better understand potential variations in dividend distribution.

A company should achieve a certain degree of solidity before it distributes dividends to shareholders. Not just financially, but in terms of governance as well.

Nicholas Hamel

Senior Account Manager, Technology Industry, BDC

Your policy should be detailed and clearly explain the advantages of distributing dividends. Here are a few tips:

1. Consider your goals

Your policy must be aligned not only with the goals of shareholders, but with those of other stakeholders too, like lenders. “If a growing tech firm needs to invest heavily in research and development, it isn’t necessarily a good idea to allocate a fixed percentage of its earnings to dividends,” explains Hamel. “It could focus more on one-off distributions, for example, following large cash inflows.”

2. State the amount allocated to dividends

Indicate the percentage of earnings that will be dedicated to dividends or the specific amount per share.

3. Justify your choice

If, for example, you plan to distribute 50% of earnings in the form of dividends, explain why you’ve decided not to reinvest the amount to grow the business or carry out specific projects. You may be considering dividend payments because your business is mature and generating steady revenue. A different firm may wish to pay exceptional dividends when it launches new services that it’s been working on for several years. Whatever the case, you need to state and justify your decisions.

4. Include any other relevant information

If your company has issued preferred shares, provide details about the dividends to which preferred shareholders may be entitled. Preferred shareholders have precedence over common shareholders in the payment of dividends. Also, include any conditions to which your company is subject. “When granting a loan, a lending institution may set conditions that limit, postpone or even prevent dividend distributions,” says Hamel.

When should you start paying dividends to shareholders?

“In general, a company should achieve a certain degree of solidity before it distributes dividends to shareholders,” says Hamel. “Not just financially, but in terms of governance as well.” However, the decision to do so is based first on the company’s vision and strategy. The board of directors must meet at the end of the year and assess earnings and future projects. It must determine what makes more sense: using financial resources to pay shareholders or investing these resources in projects.

Next step

Get a full picture of your business’s financial health by downloading our free guide: Understand your financial statements.

You can also use our free financial statements template to help you get started with your financial projections.