Are we a good fit?

Check out some of the general requirements to get a working capital loan with BDC.

| Location | Based in Canada |

|---|---|

| Time generating revenue | 12 months + |

| Profitability | Generating revenue |

| Credit history | Good track record |

Applying is easy

Perfect for projects, big and small

Move on to the next step

- Buy inventory

- Pay suppliers

- Expand into new markets

- Develop new products

- Protect intellectual property

- Launch a marketing campaign

- Obtain industry-specific certifications

- Hire or train employees

- Complete energy efficiency, green retrofit or sustainability projects

- And more

You’re in good hands

Choosing a loan is about more than just interest rates. The fine print is just as important—and our terms and conditions are designed to give you more flexibility and financial control over your business.

We’re there in good times and in bad

We’ve supported our clients through market downturns and other events beyond their control.

We're not one size fits all

We take the time to review your business needs and offer solutions that leave you enough breathing room to realize your goals.

We’re committed to you long-term

We won't change our terms and conditions or demand early repayment without a valid reason.

Build big dreams with a working capital loan

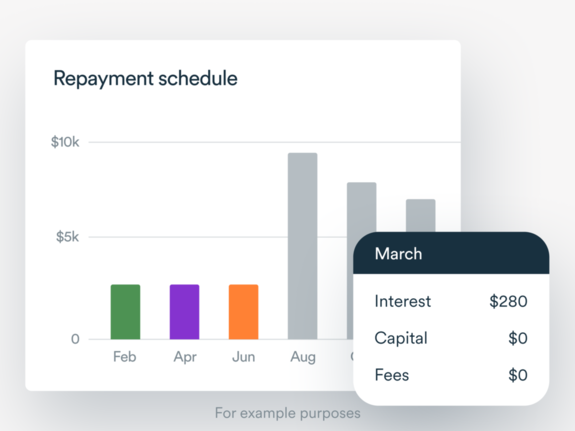

Breathe easy with interest-only payments

Take a break on us and pay only interest for up to 24 months at the start of your loan.

We look beyond your numbers

We go beyond banking ratios when reviewing a project so solid teams with worthy ideas can get an opportunity to see their projects through.

Repay, your way

Match payments to your cash flow cycle to avoid using money needed for your day-to-day activities and take up to 8 years to repay your loan.

Let’s build your success together

As Canada’s bank for entrepreneurs, we complement the role of other banks. We take on more risk, offer flexible financing and provide sound advice to help you build a strong, successful and resilient business.

The BDC difference

“ Working with BDC is refreshingly straightforward. With a simple click and signature, funds were deposited in our account within 24 hours. ”