Are we a good fit?

Check out some of the general requirements to get purchase order financing with BDC.

| Location | Based in Canada |

|---|---|

| Time generating revenue | 12 months + |

| Profitability | Generating revenue |

| Credit history | Good track record |

Applying is easy

Perfect for projects big and small

Take your business to the next level

- Take on larger orders and new clients

- Purchase more inventory to fulfill orders quickly

- Expand into new markets

- Pay suppliers upfront to get special discounts

- And more

You’re in good hands

Choosing a loan is about more than just interest rates. The fine print is just as important—and our terms and conditions are designed to give you more flexibility and financial control over your business.

We’re there in good times and in bad

We’ve supported our clients through market downturns and other events beyond their control.

We're not one size fits all

We take the time to review your business needs and offer solutions that leave you enough breathing room to realize your goals.

We’re committed to you long-term

We won't change our terms and conditions or demand early repayment without a valid reason.

Make your purchase orders go further

Pay your suppliers directly

We don’t do factoring. The funds are disbursed to you so you can pay your suppliers and reimburse BDC directly.

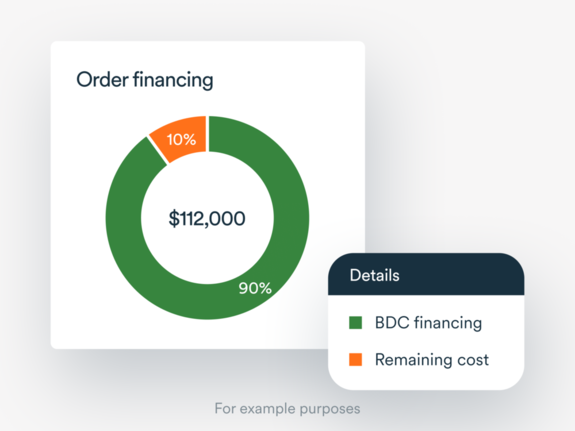

Finance a higher portion of your order

Finance up to 90% of the order value** and take up to 18 months to repay your loan.

Breathe easy with interest-only and balloon payments

Align your loan repayment to the PO payment terms. Take advantage of interest-only payments and one balloon payment at the end of the term.

Get the funds in Canadian or US dollars

We can disburse your money in Canadian or US dollars, so you don't have to worry about currency fluctuations.

Let’s build your success together

As Canada’s bank for entrepreneurs, we complement the role of other banks. We take on more risk, offer flexible financing and provide sound advice to help you build a strong, successful and resilient business.

Keep your business running at its best

** Excluding taxes, deposits and other payments received from the buyer.