Acid-test ratio

The acid-test ratio is considered the most stringent calculation of short-term liquidity. The formula for calculating it is:

Quick assets (cash + accounts receivable) / current liabilities

This determines how many dollars a business has available to pay each dollar of bills it owes. Ideally, a business should have an acid-test ratio of at least 1:1. A company with less than a 1:1 acid-test ratio will want to create more quick assets. It can do this by offering discounts to increase sales, collecting on accounts receivable (possibly offering special terms for early payment) or asking shareholders to invest more cash in the company.

More about the acid-test ratio

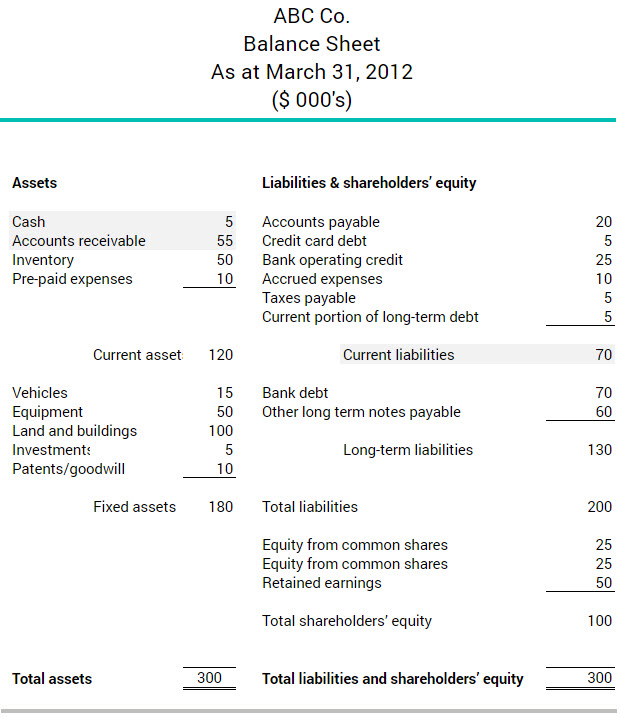

Based on the balance sheet excerpt below, ABC Co. would calculate its acid-test ratio as follows:

$5,000 + $55,000 / $70,000 = 0.86 (rounded)

This means ABC Co. has an acid-test ratio of 0.86:1, or 86 cents to cover each $1 of bills it has to pay. It may want to create more quick assets to get the ratio to 1:1.