Operating activities/non-operating activities

Operating activities are all the things a company does to bring its products and services to market on an ongoing basis. Non-operating activities are one-time events that may affect revenues, expenses or cash flow but fall outside of the company’s routine, core business.

Operating activities include:

- Setting a strategy

- Organizing work

- Manufacturing (or sourcing) products and services

- Marketing and selling its products and services

- Day-to-day management

Examples of non-operating activities include:

- Relocating the business

- Expenses caused by weather damage

- Acquiring another firm

- Buying or selling capital assets

- Drawing down or paying off a loan

- Issuing new shares

Because operating activities are routine and non-operating activities are exceptional, the two are reported separately in a company’s financial statements and financial analyses.

The reporting of operating activities helps clarify the focus of the business and its earning potential, with two key measures being cash flow from operating activities and cash flow trends over time.

Non-operating activities are included in the calculation of net income for tax purposes, but are excluded from any assessment of a company’s routine financial performance.

More about operating and non-operating activities

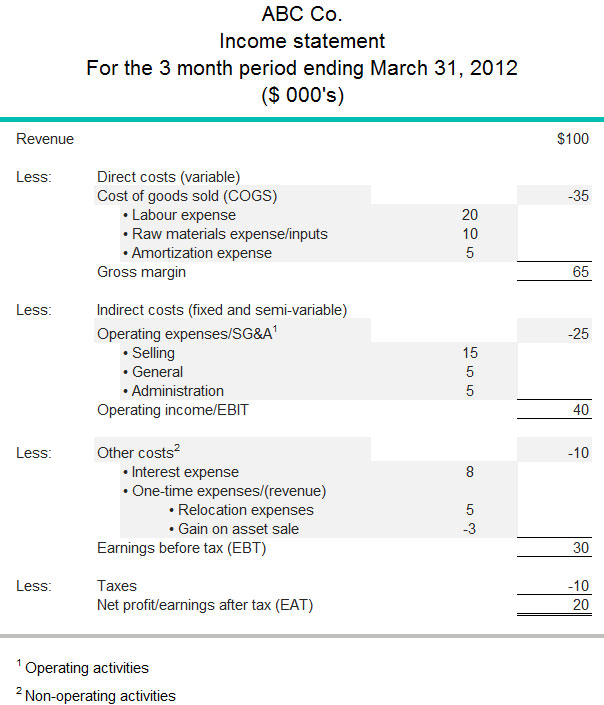

The sample income statement below shows how operating and non-operating activities are accounted for.