Cash flow statement

Cash flow statement definition

A cash flow statement is a key financial statement that records the amount of cash that comes into and goes out of a company over a specific period.

The cash flow statement records where a company’s money is coming from and where it’s going over a specific period.

Also known by three other names—statement of changes in financial position, sources and uses of funds statement, and statement of cash flow—the cash flow statement is one of the main financial statements a company can produce. Creating a cash flow statement helps you see how much cash your company has and evaluate your overall financial strength.

“A cash flow statement helps small business owners determine whether their company generates enough cash to meet its operating expenses and obligations. For this reason, those who don’t do it are at risk of running into financial problems,” explains Katrina Peng, Senior Account Manager at BDC.

What is a cash flow statement?

A cash flow statement is a financial document that reports detailed changes in cash flow over a given period of time. More specifically, it records how much money is deposited into the company’s accounts (a cash inflow), and how much money is going out of the company’s accounts (a cash outflow).

“At the end of the period, you have either a positive or negative cash balance,” Peng says.

Cash flow statements are normally prepared on an annual basis, but can also be prepared monthly, quarterly and semi-annually.

Many companies prepare a cash flow statement, but some choose not to.

Unlike the income statement and the balance sheet, which are essential for any business, the cash flow statement may not be as necessary for very small companies because it can be challenging to prepare.

A cash flow statement helps small business owners determine whether their company generates enough cash to meet its operating expenses.

Katrina Peng

Senior Account Manager, BDC.

What are the 3 types of cash flow?

Cash flow statements have a standardized structure and will normally report inflows and outflows of cash for three types of activities: operating, investing and financing.

Here are examples of financial items that may be recorded for each type of activity:

1. Operating activities

- cash collected from customers

- cash paid to suppliers

- taxes

- wages

- rent

- utilities

2. Investing activities

- purchase of equipment

- proceeds from the sale of equipment

- cost of acquiring a building

3. Financing activities

- obtaining a term loan

- paying a term loan

- receiving share proceeds

What is included in a cash flow statement?

A cash flow statement will report every cash inflow and outflow that arises from operating, investing and financing activities.

Most items are easy to classify into one of the three categories mentioned above, or to exclude altogether. However, as you can see by these questions, it can sometimes be difficult to determine the most appropriate category.

1. Are dividends included in cash flow statements?

Dividends that have been paid out must be included in a cash flow statement as a cash outflow. But depending on the accounting standard used by the company preparing the statement, it may be recorded as a financing activity, or an operating or financing activity.

Peng points out that Canada has two main accounting standards. The first one is Accounting Standards for Private Enterprises (ASPE), which she says is used by the vast majority of BDC clients. The second one is the International Financial Reporting Standards (IFRS), used by larger businesses that may be interested in moving into global markets.

In ASPE, dividends count as a financing activity, while in IFRS, a company can choose between operating and financing activities.

2. Are pre-paid expenses included in cash flow statements?

Pre-paid expenses need to be included in cash flow statements. They will be deducted for the period in which the expense takes place.

“Let’s say that in 2021 you paid $80,000 in prepaid expenses, that would mean your negative cash flow would be $80,000 in 2021. However, no expense would be incurred on the 2021 income statement,” explains Peng. “If you then incur $20,000 of those expenses in 2022, you will then record $20,000 in expenses on the income statement and add back $20,000 to your 2022 cashflow statement.”

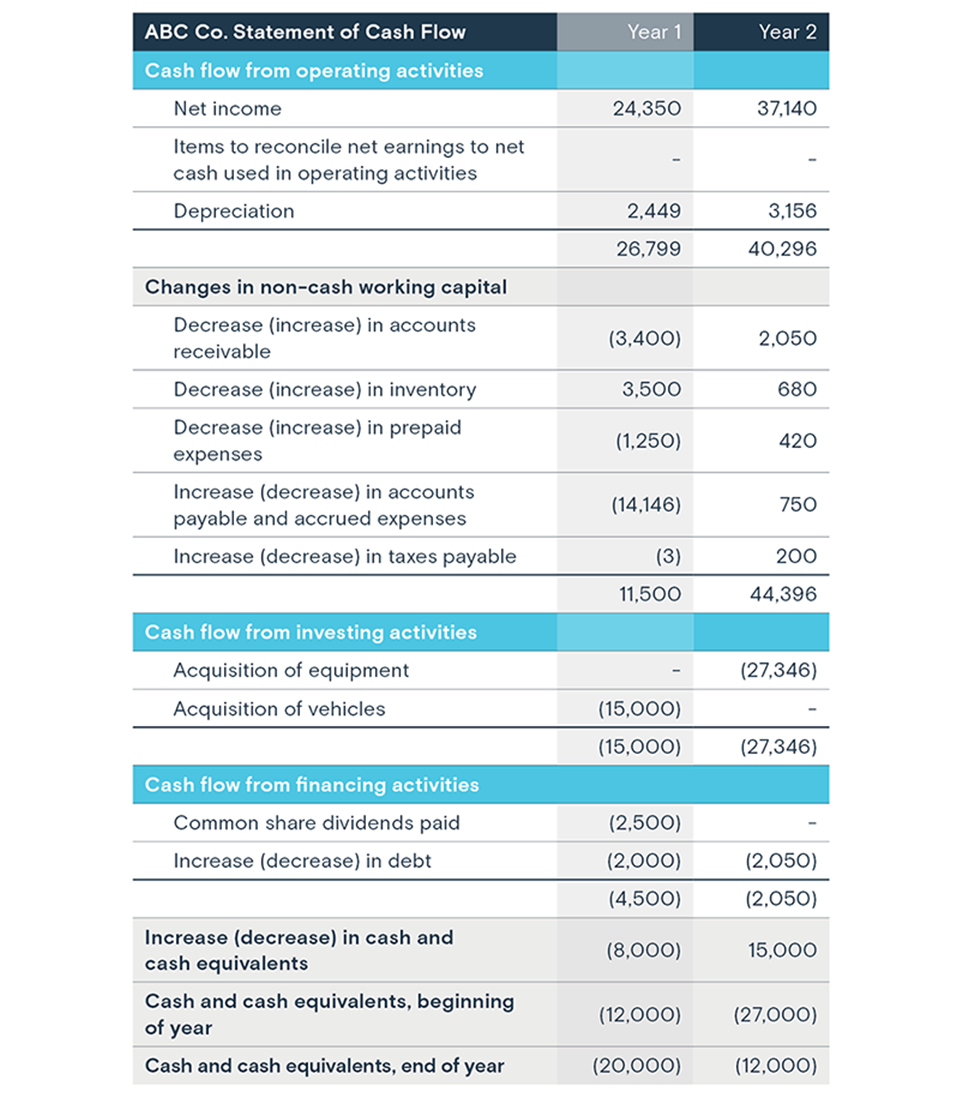

Example of a cash flow statement

The example of a cash flow statement below shows how money that was spent in Year 1 was recorded and has moved through the ABC Co. during the period.

The statement uses the indirect method. The indirect method compares the year-over-year changes in each subaccount.

The bracketed number means a decrease in cash position. So, in the case of the (3,400), ABC has issued an invoice and recorded the sale as revenue but has not yet collected the payment. In other words, the balance of accounts receivable in Year 1 would be higher than that of Year 0.

The ($15,000) acquisition of vehicles offers another example, with ABC paying $15,000 to purchase vehicles. It becomes a decrease in cash position.

Those decreases mean that at the end of Year 1, the business has a negative cash position of $20,000, meaning the business cash has been overdrawn.

For Year 2, the accounts receivable decreased year over year by $2,050 because clients have paid invoices. This will improve the company’s cash position. Taxes payable have also increased by $200. Delaying payments to supplier payables would improve cash flow.

ABC Co. also paid $2,050 in debt repayment; it is an outflow of cash to reduce the debt load.

How to prepare a cash flow statement?

To obtain a cash flow statement, business owners can prepare it themselves or ask an accountant. If an accounting firm is already handling your company’s books, and you would like to have a cash flow statement prepared, make sure to ask specifically for one, since it’s not included in all mandates:

- If a business owner asks for a compilation engagement (that’s where a chartered professional accountant will collect from the company what’s needed to put forward the company’s financial statements), the cash flow statement will not be part of that preparation.

- If a business owner asks for a review engagement or a more in-depth level of reporting, then a cash flow statement will be prepared.

There are two ways to prepare a cash flow statement. In the end, both methods will yield the same numbers. “If you don’t have money, you don’t have money,” says Peng. The difference lies in the preparation.

Here are the two methods:

1. Direct

The direct method, the more straightforward of the two, is so named because it uses actual cash inflows and outflows to build the statement instead of relying on an accrual accounting’s operating section.

If business owners are preparing their own cash flow statements, this would be the preferred method since it is the easier of the two.

Preparing a cash flow statement using the direct method involves compiling all inflows and outflows of cash. Here are a few examples of both:

- Inflows:

- Money collected from customers

- Returns on investment

- Outflows:

- Money paid to suppliers

- Salary paid to employees

- Income tax

Inflows and outflows will normally be classified into three categories of activities: operating, investing and financing. Adding up the inflows (a positive number) and outflows (a negative number) of money for each category will then yield three amounts: cash from operating activities, cash from investing activities and cash from financing activities. These three numbers are then added up to obtain the net cash for the period, that is, the amount of money your company gained, or lost, during the chosen period.

2. Indirect

The indirect method is less intuitive. It employs changes from one period to another in the line items on a balance sheet. It in turn modifies the operating section of the cash flow statement, changing it from the accrual to the cash method of accounting.

Accountants prefer it: since they are already preparing a balance sheet and an income statement, they can use those documents to quickly prepare the cash flow statement.

To prepare a cash flow statement using the indirect method, start with net income and place non-cash items, such as amortization and gains (or losses) on sales of equipment, under the income statement.

“You then calculate the changes in non-cash working capital,” says Peng. “For non-accountants, it’s a much more complicated method.”

A cash flow statement may be challenging to prepare, so typically only the companies with larger financing needs will do it.

Katrina Peng

Senior Account Manager, BDC.

Why it’s important to prepare a cash flow statement

The cash flow statement is an important document to prepare because cash is a company’s oxygen.

“Profits don’t mean a thing when if comes to your survival,” Peng says. “You can be profitable yet have no money in the bank because your clients don’t pay.” Similarly, if the company is paying dividends to the owner while there is very little cash in the company’s account, the business can quickly run into trouble.

“Conversely, you can invest in equipment, and money will seem tight at the beginning, but your asset will soon bring in cash. To a bank, the use of cash is important and investing in equipment is a good thing for long-term benefits.”

How to read and analyze a cash flow statement

Cash flow statements, unlike a balance sheet or income statement, do not lend themselves to ratio analyses.

The first step to take when analyzing a cash flow statement is to look at the net cash position: Is it positive or negative?

“If it is positive, great, you brought in cash that year. If you lost money, you need to think about how you are going to cover your losses,” explains Peng. “Are you going to improve how you collect money from clients? Will you get a loan from the bank? Will you, as a business owner, deposit your own money into the company’s coffers?”

The second step involves looking at where the money is being spent and asking whether it’s the best use of the company’s cash.

The third step is to look at year-over-year changes. If there was a big change in inventory last year, but not this year, for instance, it may be important to ask why. Has the business model changed? Are you having a hard time selling your inventory?

Normally, larger and more mature businesses will see small changes from year to year while smaller, growing businesses will see bigger ones. Nevertheless, it’s important to understand why your company has seen more money flowing in, or out, of its coffers.

Finally, the fourth step would be to build a cash flow projection, that is, to look at what your cash flow will look like in the future.

Say we’re in May and you know there is a big order coming up in September: you need to make sure you will have the money to pay for the inventory. Will you have the cash? If not, how will you pay for it? Will you get a loan?

“Cash flow projections are a useful planning tool that will help business owners mitigate risk and prepare for big decisions and actions ahead of time,” Peng says. “Especially if they are operating in a tricky line of business, like a seasonal industry.”

Next step

Download BDC’s free Cash flow projection tool to create a reliable cash flow forecast based on past results and expected revenues.