Principal + Interest payments

In a principal + interest loan, the principal (original amount borrowed) is divided into equal monthly amounts, and the interest (fee charged for borrowing) is calculated on the outstanding principal balance each month.

This means the monthly interest amount declines over time as the outstanding principal declines. As a result, a principal + interest loan results in less interest than a blended payment loan.

More about principal + interest payments

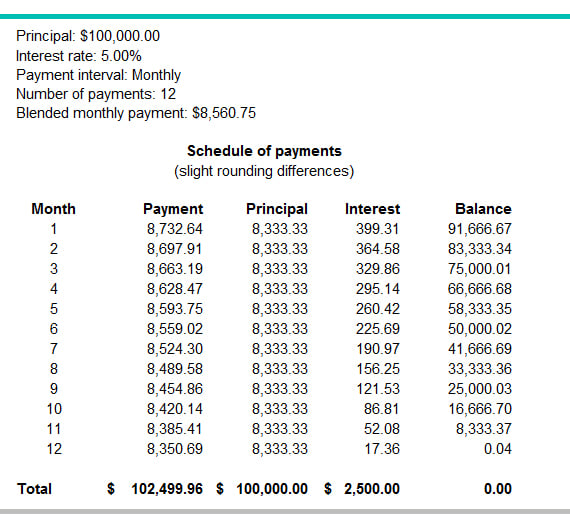

Below is an example of a $100,000 loan with a 12-month amortization, a fixed interest rate of 5% and equal monthly payments of principal + interest with a declining total payment. The principal payment stays the same each month, while the interest payments and total monthly payments decline.

Related definitions

Useful resources

Personal or business loan: Which one best suits your needs

Access to start-up financing is essential for most new businesses, but for many entrepreneurs just starting out, their biggest challenge is getting adequate financing.