Operating expenses (selling, general & administrative expenses)

Operating expenses definition

Operating expenses, also known as selling, general and administrative expenses (SG&A), are the fixed costs your business incurs that are not directly related to production.

Operating expenses—also known as selling, general and administrative expenses (SG&A)—are the costs of doing business. They include rent and utilities, marketing and advertising, sales and accounting, management and administrative salaries.

“It’s the cost of running your business,’’ says Alex Barros, Business Advisor with BDC Advisory Services in Edmonton.

Operating expenses are commonly referred to as overhead and represent indirect or fixed costs. They are indirect because they are not directly associated with the production or sale of goods and services.

Because operating costs are fixed, they tend not to fluctuate with the volume of sales. “It’s the cost that you have if you sell one unit or a thousand units,’’ Barros says.

Selling, general and administrative (SG&A) definition

What are selling expenses?

Selling expenses are the costs associated with distributing, marketing and selling a product or service.

The salaries and commissions of sales staff, as well as advertising and promotion, travel and entertainment, are all considered selling expenses.

“If you have to pay salaries, benefits, accommodation, commission, travel expenses— all the expenses related to sales—those are operating expenses,’’ Barros says. “Within the selling expense, there are some direct expenses.”

While selling expenses are considered fixed costs, they may go up if management hires more salespeople and increases commissions or spends more on marketing and advertising.

Examples of selling expenses

Selling expenses can include:

- distribution costs such as logistics, shipping and insurance costs

- marketing costs such as advertising, website maintenance and spending on social media

- selling costs such as wages, commissions and out-of-pocket expenses

What are general expenses?

General expenses are the costs a business incurs as part of its daily operations, separate from administration expenses.

“General expenses are directly related to the operation of the business. Rent, insurance, utilities, office supplies—all of the costs associated with the day-to-day running of the business,” says Barros, adding that it’s also called overhead.

General expenses are different from administrative costs in that they do not relate to the management of the business.

Examples of general expenses

General expenses can include:

- rent

- utilities

- postage

- office supplies

- computer equipment

What are administrative expenses?

Administrative expenses are the costs of paying wages, salaries and providing benefits to non-sales personnel. These include the cost of a company’s accounting, marketing or HR personnel, as well as its administrative and management staff, including outside professionals, such as accountants or lawyers, who are not salaried employees.

“Administrative costs are for managing the business. Management payroll—the professional fees, accountants, lawyers—all fall under administrative expenses,” says Barros.

It’s the cost of running your business.

Alex Barros

Business Advisor, BDC Advisory Services

Examples of administrative expenses

Administrative expenses can include:

- salaries of employees in non-sales functions

- management salaries

- fees paid to lawyers, accountants and other professionals

What is included in operating expenses?

- Rent: The cost of leasing office space or facilities.

- Salaries and wages: Payments to employees for their work that is not tied to producing the goods or services you sell.

- Accounting and legal fees: Expenses related to financial and legal services.

- Bank charges: Fees associated with banking services.

- Sales and marketing fees: Costs for advertising, promotions, and sales efforts.

- Office supplies: Expenses for stationery, equipment, and other supplies.

- Repairs: Costs to maintain and fix equipment or property.

- Utilities expenses: Bills for electricity, water, and other utilities.

- Cost of goods sold: Direct expenses related to producing goods or services.

- Insurance expenses: Premiums paid for business insurance coverage.

Where do operating costs appear on the income statement?

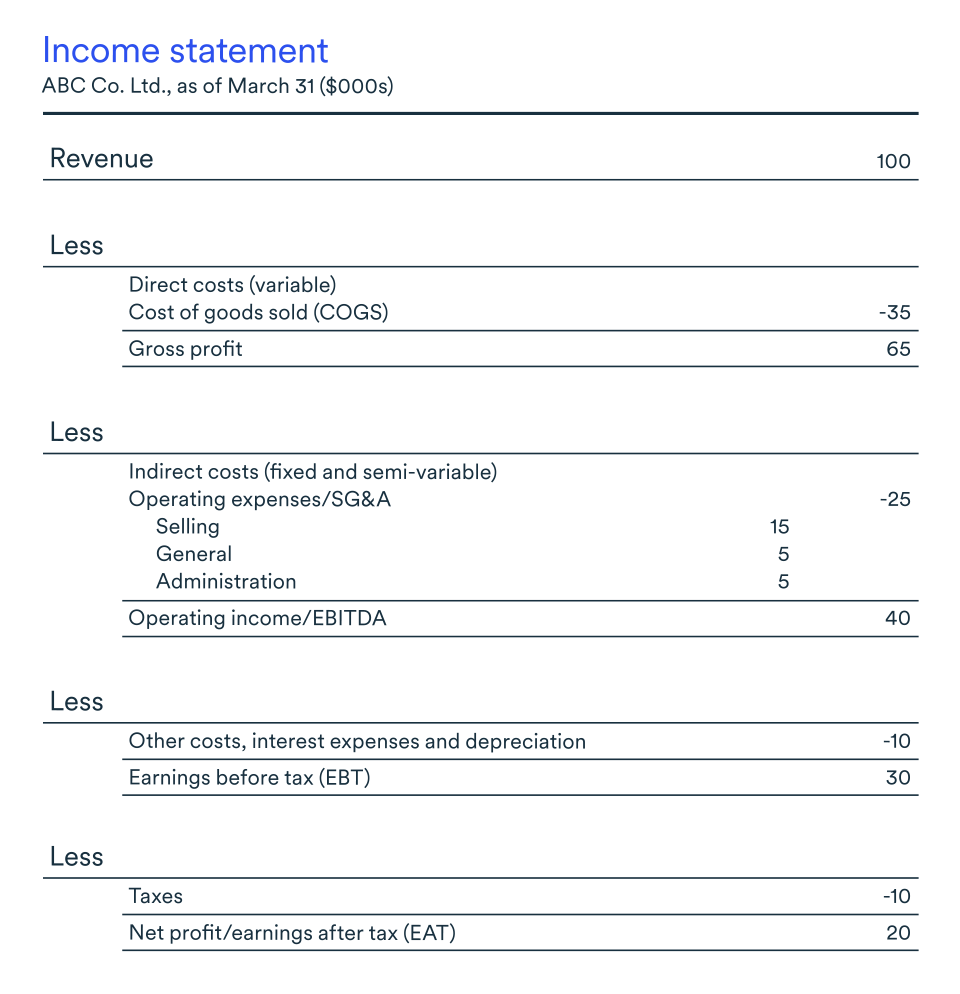

Because SG&A expenses are not considered part of the cost of goods sold, they appear on the income statement between COGS, and interest and depreciation.

If you want to keep your pre-tax profit at 20%, and your cost of sales is too high, the first place you’re going to have to cut is SG&A.

Alex Barros

Business Advisor, BDC Advisory Services

How to analyze operating expenses

A relatively high cost of sales or COGS will require attention if your company wants to remain profitable. For example, if your cost of goods sold represents $700 for every $1,000 in revenues, then your gross profit margin will be $300 or 30% of revenues.

COGS of 80%, or even 70%, of revenues is generally too high, says Barros. “You’ll have 20% to 30%, respectively, left over. That means your SG&A have to be a maximum of 10% to 20% because you need to ideally have 10% as profit before taxes.’’

Barros says companies with high COGS must be “lean and mean,’’ in order to keep pre-tax profit margins in the 10% range.

“If you want to keep your pre-tax profit at 20%, and your cost of sales is too high, the first place you’re going to have to cut is SG&A,” Barros says.

“Generally speaking, SG&A should run from 15% to 25% (of revenues), depending on the industry or business you’re in.’’

“Every single month, you have to evaluate how much you’re allocating under each COGS and SGA account,” Barros says. “You have to determine how well you’re performing in terms of cost and expense to ensure you have control over both accounts.’’

“Usually what happens is you lose control, keep going, unaware of your margins and end up spending 30% or more (of your revenues) on SG&A. Then all your profitability is gone.’’

How to control your cost of goods sold

Sometimes, companies see their cost of production or COGS increase due to a rise in the price of raw materials, transportation or other input costs that are beyond their control. In that case, company managers have a choice: raise their prices or cut their operating expenses, or they can decrease the gross margin, which is not the best solution.

“Sometimes, you can’t cut the cost of sales or COGS because the price of supplies has risen, inflation has taken place, and you don’t want to substantially raise your prices,’’ Barros says. “In that case, you’ll have to mainly cut the fixed expenses, which is the SG&A. This leads to a combination of slightly increased prices combined with a reduction in expenses.”

“When the cost of sales is too high and CFOs are looking at improving profitability by decreasing the overall cost of business, they tend to cut SG&A,’’ Barros says.

Barros recommends implementing monthly financial reporting to evaluate the business performance, establish your goals and reassess growth.

“This leads to a situation where the key financial information supports the decision-making process.”

CFOs, he says, will also look to applying a price increase if the market allows, combined with expense reduction. Those reductions will go hand in glove with productivity improvements, technology enhancements and a reassessment of long-term business strategy.

Is R&D part of operating expenses?

Research and development is not part of SG&A. R&D costs fall under COGS (cost of goods sold).

If you spend $100,000 developing a new product, that’s part of the cost of the product, making the R&D expenses direct costs.

In some cases, R&D costs can be capitalized and treated as assets, such as the purchase of materials and equipment used in the development and purchase of intangibles, like patents and copyrights.

In the case of computer software companies, all R&D spending can be capitalized until a marketable prototype is developed. Any further development costs would be treated as expenses.

Are salaries part of operating expenses?

If the employees are not directly involved in the production or provision of goods and services, their salaries will be considered an administrative expense. For example, salaries of executives, administrative or office staff, as well as accounting, legal and other professional staff, are counted as administrative expenses. However, the salaries of staff working to make a product or sell your services, will be counted in COGS or cost of sales, respectively.

What’s the difference between operating expenses and cost of goods sold?

The cost of goods sold is the sum of all direct costs associated with manufacturing a product. These include things like wages paid for employees, raw or finished materials and overhead costs for the production facility.

Operating expenses are all costs not directly incurred in the process of selling or producing your goods or services.

Next step

Discover how to analyze your financial information to increase revenues, reduce costs and set a competitive price for your goods or services in our free guide for entrepreneurs: Build a More Profitable Business.