Investments

A company’s balance sheet may show funds it has invested in other companies. Investments appear on a balance sheet in several ways: as common or preferred shares, mutual funds and notes payable.

Sometimes they are made to put excess cash to work for short periods. Other times they are used more strategically over longer periods.

For small businesses, short-term investments are typically placed in highly liquid money-market funds and/or in interest-bearing bank accounts. Longer term investments could entail the purchase of shares in a private business. These can be highly illiquid and could be made to have some control over an important relationship (for example., with a supplier or large customer).

Investments held for one year or more appear as long-term assets on the balance sheet. Investments used to generate cash within the current operating period (within 12 months) appear as current assets and are called “treasury balances” or “marketable securities.”

More about investments

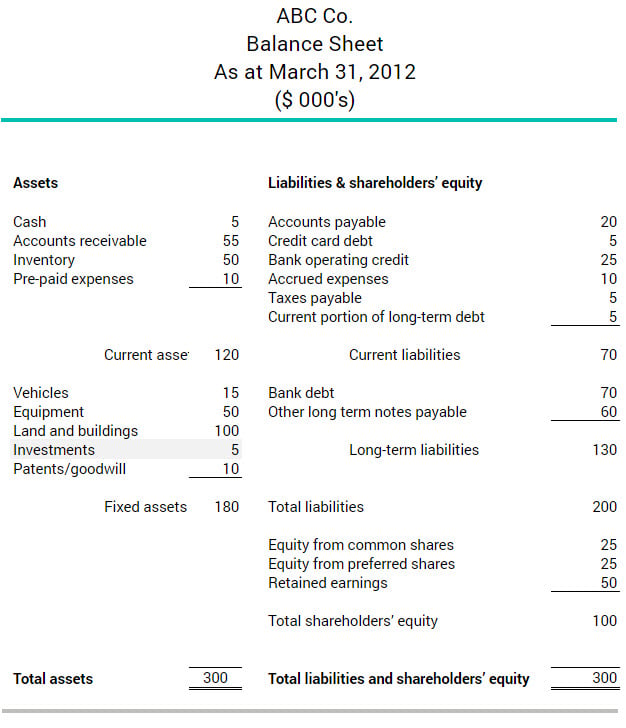

The balance sheet below shows that ABC Co. holds a long-term ownership position in another firm in the form of a $5,000 investment.