Income tax

Governments collect income tax on the profit earned by businesses in their territory—whether those businesses are corporations, partnerships or sole proprietorships.

Businesses must complete a tax return each year to determine if they owe tax, how much they owe, or if they are entitled to a tax refund (which can happen if they have overpaid their taxes throughout the year).

Businesses are legally required to pay any income tax they owe. They must also pay additional fees known as surcharges.

While the basic federal tax rate is the same for all companies, provincial and territorial tax rates and surcharges vary. This means one business may pay less or more tax than another depending on where it is located. Tax rates also change over time.

In Canada, federal income taxes are governed by the Income Tax Act. The rules around income tax can be complex, especially for companies that earn income in other countries. It is wise to hire an experienced professional accountant to help you steer through the tax laws and understand how they apply in different situations.

More about income tax

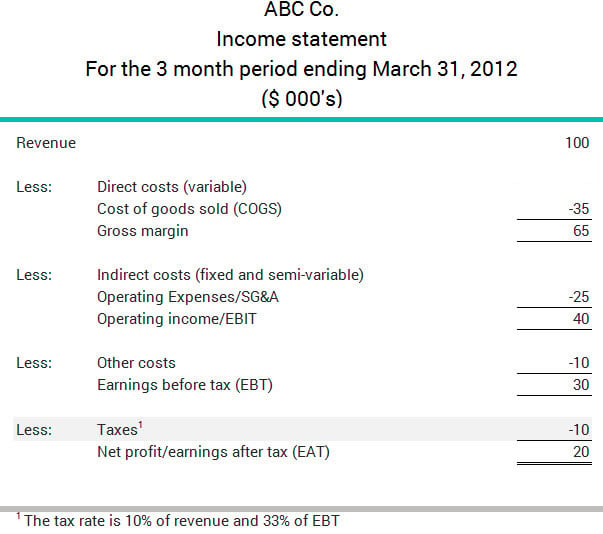

Companies calculate the amount of tax they pay on their earnings before tax (EBT), which is their profit after deducting all their direct and indirect costs and interest—as shown below: