Gross profit margin

The gross profit margin tells you what your business made after paying for the direct cost of doing business, which can include labour, materials and other direct production costs.

It’s one of three major profitability ratios, the others being operating profit margin and net profit margin. Arguably, it’s the most important of the three profitability measures because without a high enough gross profit margin, you won’t have a viable business—at least, not for long.

“If you don’t get your gross margin to a point where your revenues cover your production costs, you’re business is in trouble,’’ says Sean Beniston, a senior client partner with BDC Advisory Services in Vancouver, B.C.

How do you calculate gross profit margin?

The gross profit margin is calculated by subtracting direct expenses or cost of goods sold (COGS) from net sales (gross revenues minus returns, allowances and discounts). That number is divided by net revenues, then multiplied by 100% to calculate the gross profit margin ratio.

(Net revenue – direct expenses) Net revenue x 100% = Gross profit margin ratio

Example of gross profit margin

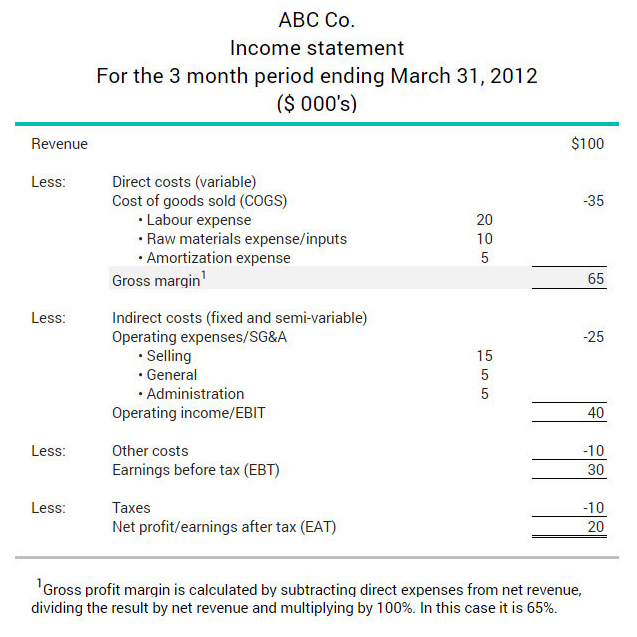

Here’s an example of gross profit margin ratio shown on the quarterly profit and loss statement of ABC Co:

In this example, ABC’s net revenues are $100,000, while its direct expenses are $35,000. When direct expenses or COGS are subtracted from net revenues, the remainder ($65,000) is divided by $100,000 (.65), which is then multiplied by 100% to produce the gross profit margin ratio of 65%.

What is a good gross profit margin ratio?

On the face of it, a gross profit margin ratio of 50 to 70% would be considered healthy, and it would be for many types of businesses, like retailers, restaurants, manufacturers and other producers of goods.

But for other businesses, like financial institutions, legal firms or other service industry companies, a gross profit margin of 50% might be considered low.

Law firms, banks, technology businesses and other service industry companies typically report gross profit margins in the high-90% range. That’s because service sector firms typically have much lower production costs than goods-producing companies.

In contrast to that of service sector firms, the gross profit margin ratio in clothing retailing can range anywhere from three to 13%, while some fast-food chains can achieve gross margins as high as 40%.

“Gross margin is incredibly important to get right,’’ says Beniston, CPA and MBA. “But it’s relative. If I’m a manufacturer of heavy equipment, it wouldn’t be beneficial to compare my gross margin to that of a retail operation for benchmarking purposes.’’

Why is the gross profit margin ratio important?

While the gross profit margin ratio can help business owners and professional advisers assess a company’s financial health, it’s best used to track a company’s performance over time or to compare businesses in the same industry.

The gross profit margin ratio will not only tell you whether your business is achieving the industry benchmark, it can be used as a target to exceed the industry average.

Beniston said business owners can use the gross profit margin ratio to “benchmark against the industry. Then set some goals and track over time. So, let’s say the industry benchmark is 65%, let’s be sure we’re comparable, and if so, strive to get to 70%. The key then is to track on a month-to-month basis, to monitor how you are doing against the industry and the goal you set.”

How to analyze the gross profit margin?

Theoretically, as you grow your revenues, your cost of goods sold should rise proportionately, Beniston says. “If your cost of goods sold goes up faster than your revenue growth, then you’ve got a problem. When those trend lines converge your ability to remain profitable is in jeopardy.”

It may be that your cost of goods sold has increased, but your pricing hasn’t risen to reflect the change in costs. Or your business operations are less efficient than your competition, which is causing your COGS to increase faster than your revenues.

“If you’re falling behind your industry, make sure that—if it’s not explainable by uncontrollable events—you become introspective and ask, ‘how can we do better?’ The gross profit margin ratio really focuses in on your pricing strategy and your operational efficiency,’’ Beniston says.

Factors that affect operating efficiency include the cost of labour, material and other variable costs of production.

How to improve your gross profit margin?

Raise prices

Raising prices is an obvious solution, but it’s not always the best strategy, especially in a low-margin business or competitive industries, like retail sales, food service or warehousing. “When you have small margins, you have less margin for error,’’ Beniston says.

“If your costs of production have gone up because freight costs or the price of raw materials have gone up, for example, you can do one of two things: One, you have to raise your prices. Or, two, you need to rein in your operating systems so that you reduce your cost of sales.”

Improve efficiency

If you can’t pass those higher costs onto consumers, then you may have to find efficiencies in your operations by reducing labour costs or investing in plant and equipment or both.

“If I’m an aluminium can manufacturer, I don’t have any control over the costs of aluminium. So when I see price fluctuations, I have to pass the costs onto my consumers. There’s really not a lot you can do, unless you find opportunities automation or machinery that can replace your direct labour or production costs.”

Gross profit margin and start-ups

Start-ups typically have lower gross profit margins because their operations may not have the efficiencies that more mature companies have developed over the years.

On the other hand, some start-ups, particularly sole proprietorships, may have above-average gross profit margins because the owners are not taking full payment for their labour, effectively subsidizing their businesses.

“Oftentimes, entrepreneurs won’t value their own time and calculate that into their gross margin,’’ Beniston says.

But even if they don’t pay themselves, fledgling entrepreneurs should account for their hours of work, if for no other reason than to provide a more accurate picture of their gross profit margin.

What are the limits of the gross profit margin ratio?

Of course, the gross profit margin ratio has its limitations in terms of what it can tell you about the efficiency, profitability and long-term viability of your business.

Other profitability measures, like operating profit margin and net profit margin, will tell you more about how efficient and profitable your business is, after accounting for fixed or overhead costs, depreciation and amortization, as well as interest costs and taxes.