Credit card debt

Credit card debt is money a company owes for purchases made by credit card. It appears under liabilities on the balance sheet.

Credit card debt is a current liability, which means businesses must pay it within a normal operating cycle, (typically less than 12 months).

While they tend to have high interest rates, credit cards are a convenient source of short-term credit because they allow businesses to make small purchases right away. Interest charges accrue monthly and payment of that interest is mandatory.

Discipline is key to managing credit card debt successfully. The ideal approach is to cover the full amount each month to avoid accruing interest. If a balance builds on a company credit card, the business can use its cash flow to make a lump sum payment at its discretion.

Credit card debt is unsecured, which means payment terms are short. If a company fails to pay according to the terms of its credit card agreement, the card supplier may demand full repayment at a high rate of interest.

More about credit card debt

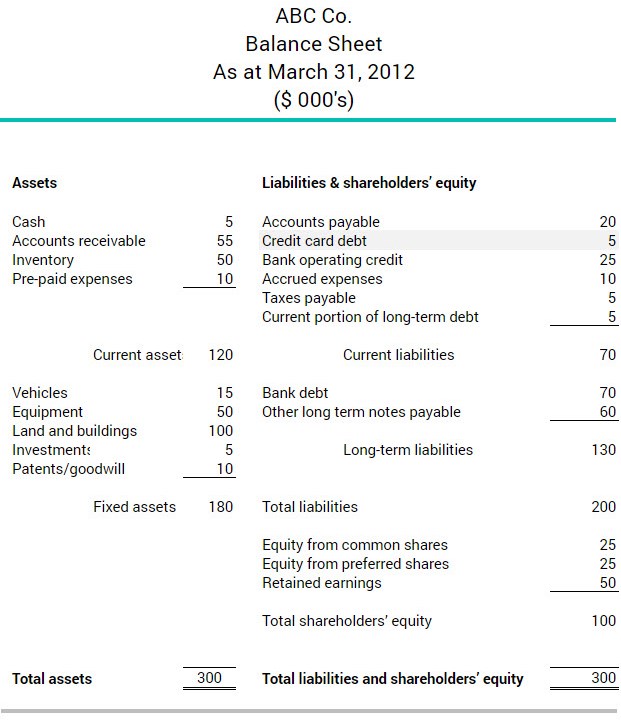

The sample balance sheet below shows ABC Co.’s current liabilities including credit card debt as of March 31, 2012.

Useful resources

How to account for assets and expenses in your start-up

Free and low-cost accounting software

Free guide: Master your cash flow

Get your step-by-step guide to purchasing a place of business so you can understand whether it’s the right move for your company, who can steer you through the process to avoid common pitfalls, and what you can do to budget, negotiate and finance your purchase effectively.