Capital structure

Capital structure is the mix of debt and equity on a company’s balance sheet. It shows how much of a company is financed by creditors and owners, and also provides insights into the company’s cost of capital—how much the capital in the business is costing the owners.

More about capital structure

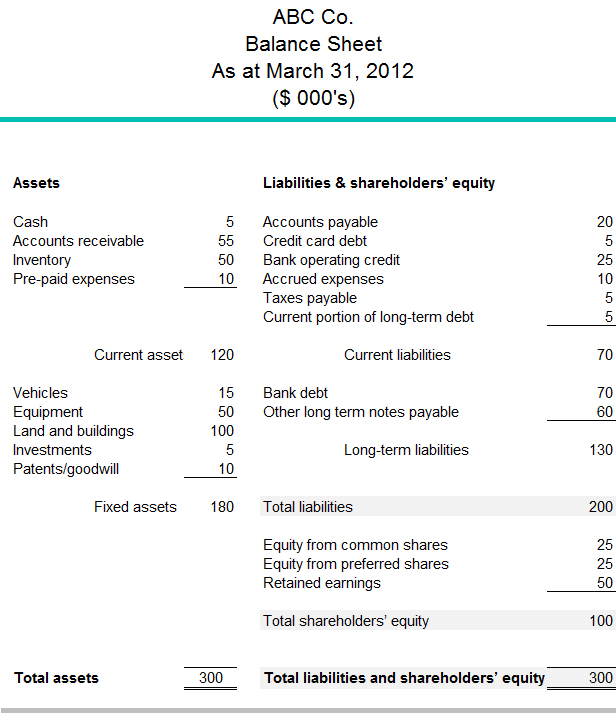

The balance sheet below shows that one-third of ABC Co.’s capital is provided by its owners, while the remaining two-thirds is provided by creditors. This heavy reliance on creditors suggests the owners’ cost of capital is lower because the cost of debt (interest) is tax-deductible whereas dividends—the “cost” of equity—are not.

An even fuller understanding of ABC Co.’s capital structure would come from reviewing its notes to the financial statements.