Debt-to-asset ratio

Is it risky for a bank to lend money to your company? To find out, the bank will look at your debt-to-asset ratio.

This ratio determines a company’s level of indebtedness, in other words, the proportion of its assets that is owned by its creditors. It is one of three ratios that measure a company’s debt capacity, the other two being the debt service coverage ratio and the debt-to-equity ratio.

In general, a bank will interpret a low ratio as a good indicator of your ability to repay debt or raise other loans to pursue new opportunities. A high ratio, on the other hand, indicates a substantial dependence on debt and could be a sign of financial weakness.

How to calculate the debt-to-asset ratio:

Formula

Complete the fields below:

How do you calculate the debt-to-asset ratio?

To calculate the debt-to-asset ratio, you must consider total liabilities. “It includes current liabilities repayable within 12 months of the end of the fiscal year—such as accounts payable and other payables—the current portion of the debt, and long-term liabilities repayable beyond 12 months—such as a mortgage loan minus the current portion,” says Florence Bessette, CPA auditor, Business Advisor, BDC Advisory Services.

“Total liabilities really include everything the company will have to repay,” she adds.

Total liabilities will have to be divided by the company’s total assets to obtain the debt-to-asset ratio. “We include current assets—in other words, what the company currently has, such as cash—and other assets that will be converted into liquidity in the 12 months following the end of the fiscal year, such as accounts receivable,” says Bessette. “Then, we include long-term assets, such as long-term investments, and tangible assets. Total assets consist of all of the company’s resources.”

Leverage can be an interesting option for a company since it can enable growth. But it must be used wisely.

Florence Bessette

CPA auditor, Business Advisor, BDC Advisory Services

Example of a debt-to-asset ratio calculation

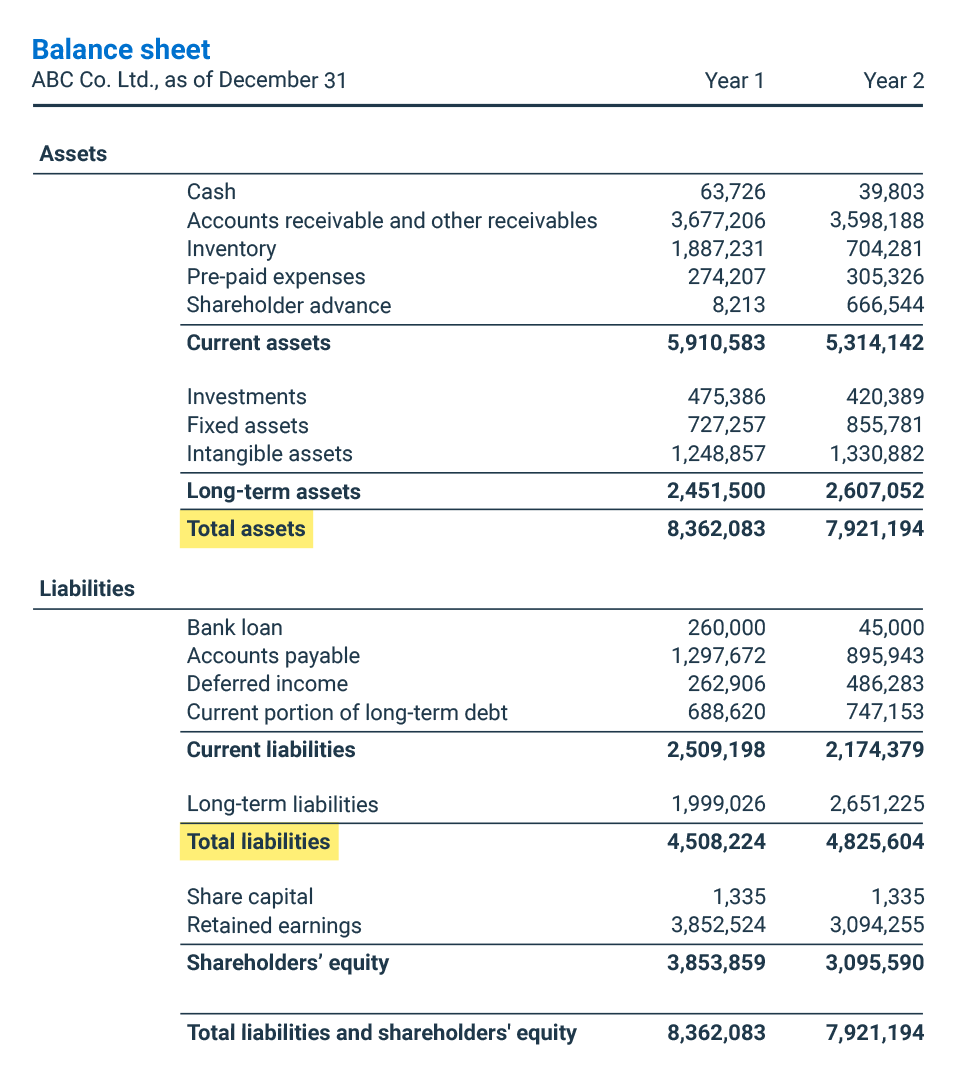

In the example below, the debt-to-total assets ratio is 54% for year 1 and 61% for year 2. This means that in the first year, creditors owned 54% of the assets, whereas in the second year, this percentage was 61%.

Here is the calculation:

Company’s total liabilities (current liabilities + long-term liabilities)

Company’s total assets (current assets + long-term assets)

Year 1

4 508 224

8 362 083

= 0,54

Year 2

4 825 604

7 921 194

= 0,61

How do you analyze the debt-to-asset ratio?

The debt-to-asset ratio is primarily used by financial institutions to assess a company’s ability to make payments on its current debt and its ability to raise cash from new debt. This ratio is also very similar to the debt-to-equity ratio, which shows that most of the assets are financed by debt when the ratio is greater than 1.0.

A company that has a high debt-to-equity ratio is said to be highly leveraged. Highly leveraged companies are often in good shape in growth markets, but are likely to have difficulty repaying debt during market downturns. It’s also more difficult for them to raise new debt to ensure their survival or to take advantage of market opportunities.

Not only is it normal for a company to be in debt, this can even be a positive thing.

“Leveraging can be an interesting option for a company that can use the debt to generate additional resources,” explains Bessette. “For example, to increase its productivity, a company can buy a commercial building for a space that is larger and better adapted to its needs. Next, it can purchase state-of-the-art equipment that will enable it to fulfil more contracts, more quickly, for its customers. Using debt allows the company to keep its liquidity for its working capital.”

However, you should consider that for banks, there is a financial risk in increasing its lending to a company that already has a high debt-to-asset ratio. “First, the company will have less collateral to offer its creditors, and second, it will be incurring greater financial expense,” explains Bessette.

“It’s also important to know that a company with high debt will get a higher interest rate on future loans because the risk to lenders is higher,” says Bessette.

Therefore, the interest to be paid will lower the company’s profitability. In addition, debt payments will reduce its liquidity.

“Leverage can be an interesting option for a company,” says Bessette. “But it must be used wisely.”

What is a good or bad debt-to-asset ratio?

To know whether a debt-to-asset ratio is good or bad, you have to compare it to that of other companies in the same line of business.

“Some companies, like manufacturers, need a lot of equipment to operate, which requires more financing,” explains Bessette.

To determine whether the debt-to-asset ratio is good or bad, you also have to look at a company’s level of growth. “If a company has a high debt load, but it’s generating a lot a lot of liquidity, then it will be a lot less risky for the bank to loan it money because the company will have the ability to repay,” says Bessette.

It is generally agreed that a debt-to-asset ratio of 30% is low.

Florence Bessette

CPA auditor, Business Advisor, BDC Advisory Services

The average debt-to-asset ratio by industry is provided on the Statistics Canada website. Several businesses also sell this data.

“It is generally agreed that a debt-to-asset ratio of 30% is low,” says Bessette.

How do you improve your debt-to-asset ratio?

Unless you suddenly make windfall profits that rapidly increase your assets, you will need to repay debt to improve your debt-to-asset ratio. “Ideally, you want to start by paying off the debts with the highest interest rates,” says Bessette.

But, you have to approach it strategically. “You have to reduce your debt as much as possible,” says Bessette. “To do this properly, financial forecasting must include debt repayment and sufficient cash flow to avoid harming a company's operations.”

Next step

Download our free digital guide, Monitoring Your Business Performance, to better understand how to measure your liquidity, operational performance, profitability and financing capacity.